Written by Grant G

I received an email from a regular reader of The Straight Goods....

The man, a senior in a residential government run carehome emailed me...asking me to talk to John Horgan about an issue that affects many low income seniors....The man's frustration was on two fronts...the first being, clawbacks....there are many seniors in British Columbia who are on, classified as disabled,.....those on provincial disability receive about $1100 provincial dollars per month...

These disabled seniors, many if not most also receive old age Canada pension, OAS pension pays approximately, if eligible for all the federal benefits is approximately $1600 .....the problem is...every single dollar of Federal money is clawed back by the province.....not $1 extra dollar is handed out by British Columbia....I am aware that many seniors receive less money...the point being..if a seniors has been labeled disabled by the province,.... receive approximately $1100 dollars...if same senior is entitled to $1200...$1400... $1600 per-month of Federal money...That $1100 is clawed back, all of it..

Leaving these seniors, without one extra dollar...and in expensive British Columbia...$1600 per month...$1400...$1200 per month is he poverty level...

Also troubling Mr. Hearn.....

He attempted to contact many in the new John Horgan NDP government...only to receive automated responses, multiple attempts over months and all he received back was a cold automated response...

That's why Mr. Hearn asked for my help...wanting me to talk to Premier Horgan..

Affordability in B.C......$1600 dollars all in monthly income in British Columbia is well under the poverty level...those in government seniors facilities surrender the bulk of their monies

Mr. Hearn is wondering why 100% of his OAS is clawed back....why can't a single dime of extra money go to these poor seniors....Mr Hearn does not care if there's a means test...meaning, if some seniors have other incomes, or a large financial portfolio or cash coming in from business, investments or other sources of income....they don't need the extra income...

But as Mr. Hearn explained to me....where he's at...besides being a month to month pauper, living on the margins, he's not alone..

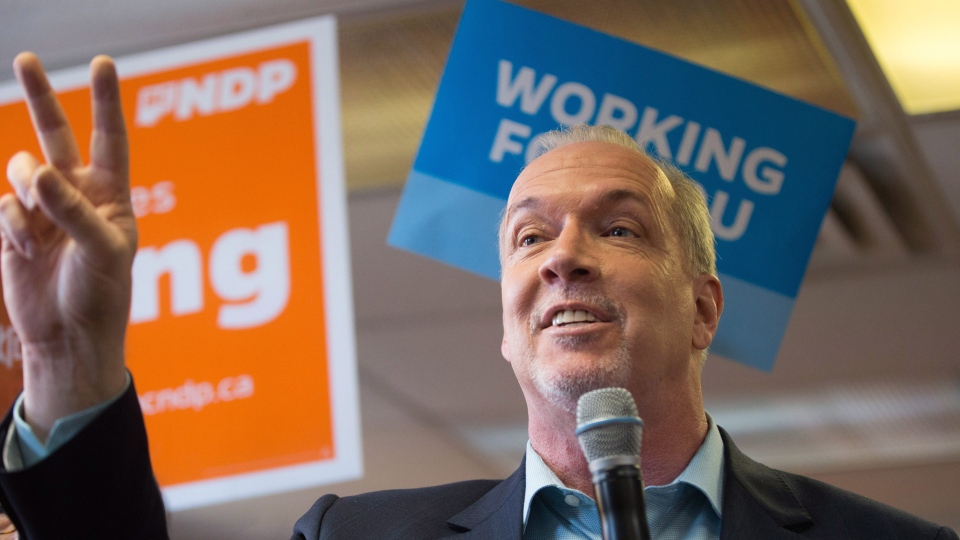

Mr. Hearn is wondering why John Horgan, who campaigned on making life more affordable for struggling BCers....is not only silent on this issue, but even refuses to engage one on one...

I have to agree with Mr. Hearn, on both counts and more....

Mr. Horgan.....Why can't seniors of little means keep some of the disability money...$100 per month...$200..$300 per month...something? Anything?

There's another issue involving seniors......those seniors that have no income except Federal pension money or Provincial disability money...have no taxable income..

My mom(who has no taxable income)...for my mom to stay in her home, ...a stairlift was required...a adjustable hospital bed...hand rails...CPAP...lift chair.....

All of those items...totaling over $10,000.00......those items are tax deductible.

The problem is....if the senior(s) have no taxable income.....there is no ability to write off, or deduct from taxes owed...in other words...poor seniors who need medical equipment to stay alive, or stay in the home have to pay the full shot, out of savings or borrow the money..

While wealthy seniors with taxable income can write off those medical necessities, poor seniors get nothing...nothing but the bill...

In my opinion, this is wrong...wealthy seniors theoretically get these items free.....poor seniors with no taxable income have to pay, or leave their home....

Mr Hearn is wondering.....wondering why John Horgan, who campaigned on making life more affordable is ignoring this burning issue among poor seniors....Mr. Hearn is also wondering why the John Horgan government is ignoring him....emails to many members of the Horgan government....emails ignored, no human response back..just a cold automated response that the email was received..

I phoned Mr. Hearn .....we had a lengthy conversation....we discussed the issue...seniors in government care homes with a mere $200 per month left over..no money for CPAP machines, or in some cases, functional wheelchairs, or powerchairs

Is that the best British Columbia can do...the best Canada can do...

It's always the case, those with wealth can access all the rebates, tax deductions and more, while the poor have to pay..and those seniors who can't afford to pay...they have to do without...

My questions to you premier Horgan......are you prepared to allow poor seniors to keep a little bit of their provincial disability money and stop the 100% clawback..

and lastly....Premier Horgan...are you prepared to offer cash credits to poor seniors who have no taxable income, cash credits for medically needed devices purchased....items like wheelchairs...hospital beds..CPAP...stairlifts...etc etc etc...

Premier Horgan.....you have Mr. Hearn's phone number..and you have all his emails, not one answered...

Are you prepared to make the simple, easy changes to make life more affordable for poor seniors with no taxable income...

Or will you merely punt the issue to the federal government and do what the BC Liberals have done over the last 16 years...ignore the problem..

Mr. Hearn came to me because he believes I have the ear of the premier....well, I do when it comes to getting Horgan elected....we'll see if that ear extends to issues that affect regular British Columbians...

You talk the talk John Horgan.....

Time has come for Premier John Horgan to.....Walk the walk..

The Straight Goods

Cheers Eyes Wide Open

6 comments:

Thank you for helping

Thomas

I find it interesting that food banks and real poverty came after the government stopped giving cash refunds and mover to nonrefundable tax credits.

It only benefited the the wealthy and impoverished the poor even further.

Indeed Mr. Evil eye....governments cater to the wealthy...the poor can eat cake, or is that stale bread..

My wife and I are retired with minimal income, (government pension and rrsps). We donate to charities, a political party and have several thousands in medical expenses. These deductions have no effect on our taxes. Last year, $200 charity donations, $400 political donations and about $2000 in medical expenses had no effect on tax.

don'y know what you are attempting to say Rob...you said nothing at all...please try to clarify....

more and more of the government programs, such as medical equipment write-offs, energy retrofits...governments offer incentives to people to do things...if incentives are based on deducting cost from taxes owed....it fails those seniors, and non-seniors who have no taxable income...

for example...my own mother..hospital bed..$3000...stairlift..$3500...loft chair..$2000..CPAP $1500...there's $10,000.00...that's just scratching the surface...

if...if my mom had taxable income...she could write-off those medical expenses..she has no taxable income..only OAS...therefore she has to pay, or do with out..many many seniors are forced to do with out..

in other words...the wealthy can take advantage of all the offerings available..

and more...many seniors are too proud to beg, or too proud to use a go fund me..they suffer silently..doing without..

Problem could be resolved by making those medical expenses recoverable through tax write off and or cash rebate..either or...

Simple solutions are available.....

Sorry Grant, it is like you stated, seniors without income pay. I do about 20 tax returns each year for friends and family, as that was one aspect of the business I was in. Using a tax program I enter our income from CPP and OAS. Then I enter RRSP withdrawals and the tax deducted for each of us. We have no tax payable. We get back the taxes taken for RRSP withdrawals. I can now enter deductions for charitable donations, political donations and medical expenses and this of course has no effect. Just for a trial I entered our unusable deductions into the taxes I did for our non-retired friends. These deductions decreased their tax payable and increased their refund by $462, not a lot but would have covered the cost of the new cloths dryer we just replaced.

Post a Comment